Own vacation property - pros and cons

Have you ever returned home from a great vacation and wish you lived in this little piece of paradise for ever? You drift into the good memories and mentally relive them over and over again. Just at such an emotional moment comes the idea of buying a second home in your favourite destination. However, along with all its positives owning a vacation property comes with many shortcomings - some of them obvious, others not that much . And before embarking on this adventure, it is good to get well familiar with all of its pros and cons.

Advantages

- Potential price appreciation

- Extra money by renting it out

- Travel light and cheaper

- It’s all yours

In popular vacation spots, real estate values tend to go up. It’s no wonder real estate investing is a popular choice for investors looking to grow their assets.

After all, if it's a second home, you won't be spending all your time there. You can use this as an opportunity to rent it out and generate income to, for instance, pay your mortgage or simply cover its cost of depreciation.

You can travel light if your vacation needed things are already there. No more heavy suitcases and checked baggage fees. And if you use the property more often during the year, your costs will be lower compared to the costs when staying in a hotel.

You can use the property whenever you want and furnish and decorate it entirely to your liking.

Renting out - advantage or disadvantage

Earning extra money by renting out your property sounds great, but let's first consider what you might be up against. You’ll need to advertise, clean and prepare your property for its next guests. You'll also need to handle the paperwork for each rental and to inspect the property for potential damages. But even if no single tenant does any real damage, having different renters in the property year after year will require more maintenance and repair work than you’re probably doing on your primary residence. To put it mildly, managing a vacation property with short-term rentals is a part-time job. Yes, that’s what’s really happening. Of course, there are management companies that could handle all of this for you. But if you go down this route, expect to pay a fee of between 20% and 30% of the your property's rental income.

Disadvantages

- Initial purchase costs

- Repairs, maintenance, administration

- Fixed ownership costs

The biggest problem is that it requires a lot of money to purchase one. In addition, new property owners typically have additional costs of furnishing, costs that can easily exceed 25% to 33% of the purchase price.

Property owners spend a great deal of time and energy to administer the property such as paying bills and taxes. They also spend significant amount of time and energy to repair problems in their properties, furnish and maintain them.

A vacation property comes with fixed annual ownership costs such as common parts maintenance fees, furnishing costs, repairs, property taxes, insurance, cable TV and internet, renovation costs etc. When all of these costs are summed together you might get a surprisingly high amount of annual fixed costs. Having this in mind, owning a vacation property is only worth it, if you are going to use it very often, for instance 100 or more days a year. That is not the case for most people. Holiday properties are used 30 days on average annually. If you divide all the time and money spent on these 30 days a year, you will quickly find out that it is both very expensive and very time consuming to own a holiday property considering the number of days it is being used.

Annual cost analysis of a vacation property

The time and energy spent on owning a second home is hard to measure. Therefore, in this section we will focus on the analysis of a vacation property annual costs with sample parameters.

Property parameters

| Property type | Purchase price | Size | Backyard size |

|---|---|---|---|

| House | 500,000.00 EUR | 200 ㎡ | 800 ㎡ |

Fixed annual еxpenses

Fixed expenses are costs that must be paid, regardless of the property’s occupancy level. Property tax is an example of a fixed cost. Another example is insurance. In both cases, a property owner pays a fixed amount regardless if they use the property or not.

| Fixed expenses | Value |

|---|---|

| Maintenance (common parts) | 800.00 EUR |

| Interiors depreciation | 2,000.00 EUR |

| Insurance | 250.00 EUR |

| Property taxes | 250.00 EUR |

| Cable TV and Internet | 150.00 EUR |

| Total per year | 5,450.00 EUR |

Depending on the duration and frequency of use of the property, different values of the fixed costs per day can be derived. The following table shows the size of the average daily fixed costs of our example holiday home for different durations and frequencies of use. If we only use it 44 days a year, our average fixed costs would be EUR 123.86 per day. However, if we use it for all 365 days of the year, the average fixed costs would drop to EUR 14.93 per day. The numbers are clear: the more often we use the property, the lower our average daily fixed costs for the property will be.

| Total fixed costs per day | Value |

|---|---|

| Used 365 days a year | 14.93 EUR |

| Used 44 days a year | 123.86 EUR |

Variable еxpenses

Variable expenses are costs that fluctuate with the level of a property’s occupancy. The following table reflects the variable cost amounts per day depending on the season of occupancy.

| Variable expenses per day | Summer | Winter | Average |

|---|---|---|---|

| Electricity | 5.00 EUR | 5.00 EUR | 5.00 EUR |

| Heating/air conditioning | 5.00 EUR | 30.00 EUR | 17.50 EUR |

| Water | 1.00 EUR | 1.00 EUR | 1.00 EUR |

| Total | 11.00 EUR | 36.00 EUR | 23.50 EUR |

One-time costs

Similar to variable expenses, one-time costs only occur if the property is occupied, but these are paid once for an entire stay and regardless of its duration. A good example for such a cost is the cleaning fee.

| One time costs | Value |

|---|---|

| Cleaning | 25.00 EUR |

Week long stay costs

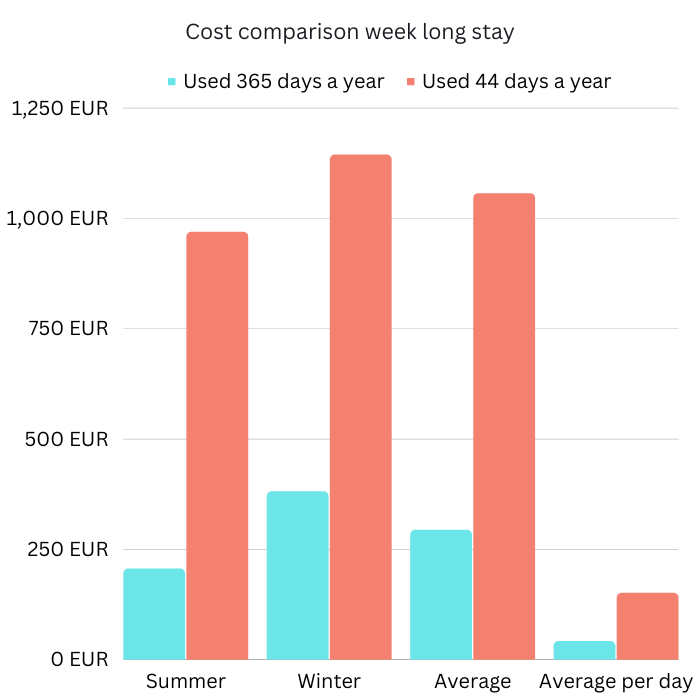

Now that we've got the full list of cost types and sample values, we can do a comparison for a week long stay in different seasons.

The costs associated with a week's stay in our example luxury holiday villa is just over 1000 EUR if the villa is only used 12% of the time. If the same villa is 100% used, then the average cost of a week's stay will drop to around €380 in the winter and around €200 in the summer. This makes total savings of around €750 per week or around €4,500 for 6 weeks a year.

The bottom line

In this article, we have looked at and analysed the advantages and disadvantages of owning a vacation property. We can conclude that there are two main financial disadvantages:

- large initial capital to purchase it

- low level of occupancy, which leads to higher average costs per used day.

Renting out can only solve the latter problem, but not the former. And let's not forget that it also comes with its drawbacks, which we discussed earlier.

Alternatively, you can purchase a fraction of the property. This option requires significantly less purchase capital and subsequently results in much lower annual operating costs. Fractional ownership is not a new concept, but recently it has become increasingly popular as an alternative to owning a whole vacation property.

If you want to learn more about fractional ownership, the problems it solves and its advantages over traditional ownership, continue to the next article.